According to Future Market Insights (FMI), the banking-as-a-service (BaaS) platform market is poised to register a CAGR of 16.2% from 2023 to 2033. The market is expected to reach USD 3,713.7 million in 2023 and USD 16,715.3 million by 2033.

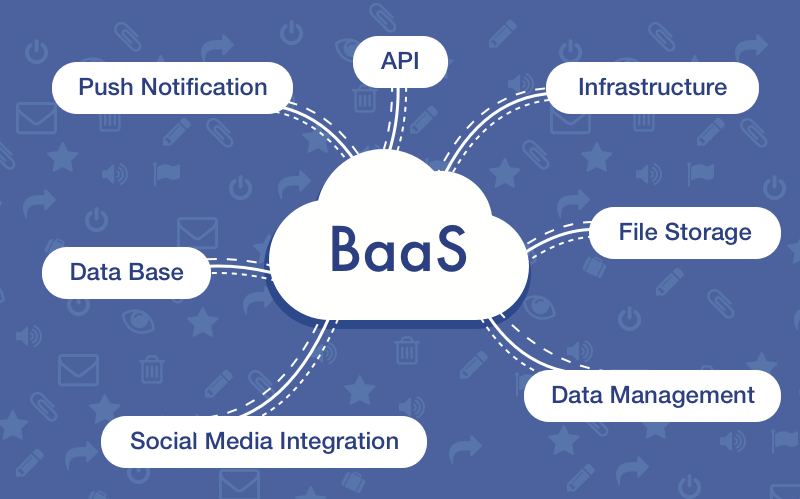

BaaS is an end-to-end model that enables online banks and other third parties to link directly with bank systems via APIs, allowing them to build banking offerings on top of the providers’ monitored infrastructure while also unlocking open banking possibilities, transforming the worldwide financial services scenery.

A number of nations have started to implement open banking legislation, signaling that the financial services sector is headed towards an era in which shared data and infrastructure will become a requirement of customers. Legacy banks that develop their own BaaS Market platforms today will not only be ahead of their competitors in the open banking potential but will also unleash a new revenue stream by financing their services.

Uncover the Massive Potential of the Banking-as-a-Service (BaaS) Platform Market – Get Our Sample Report Now

Furthermore, rising knowledge of Internet banking is propelling the BaaS business forward. Because clients use Internet banking to access a range of services, such as 24-hour banking, money transfers, balance checks, account statements, and electronic purchases, delivering these services is undeniably more dependable.

Key Takeaways

- According to the analysis, the United Kingdom would increase at a CAGR of 16.1% during the next few decades.

- The United States has emerged as a key market, accounting for more than 36.3% of global demand in 2022.

- Between 2023 and 2033, sales in India are expected to expand at a 26.1% CAGR.

- By solution, banking as a service APIs held a strong 46% market share in 2022.

- The market increased at a 14.1% CAGR during the previous five years (2018-2022).

“Many experts in the fintech industry now view embedded finance as a new opportunity for banking-as-a-service to flourish, when non-fintech firms add credit or debit cards, loans, or other financial services to their offerings. This has resulted in the development of new growth opportunities for fintech firms in the BaaS platform market.” Says FMI

Competitive Landscape

A large number of industry leaders in the banking-as-a-service (BaaS) platform market are developing sophisticated and new solutions to fulfil the ever-changing demands of diverse organizations.

- In June 2022, Raiin Bank, a German BaaS provider, proposed to acquire Bankhaus August Lenz, a German private bank. With this transaction, Raising Bank enters the monetary market. Raisin Bank will be able to provide digital payment services as well as cash choices to its affiliates and clients.

- Temenos (Switzerland) announced the formal launch of Qik Banco Digital Dominicano on the Temenos Banking Cloud on March 16, 2023. It is now the Dominican Republic’s first digital-only bank and a Grupo Popular affiliate.

Key Players

- Sopra Banking Software

- Solarisbank AG

- Bankable

- Treezor

- 11:FS Foundry

- Clearbank Ltd.

- Q2 Software, Inc.

- Green Dot Corporation

- Sterling National Bank

- Banco Bilbao Vizcaya Argentaria (BBVA), S.A

- Unit Finance Inc.

- Starling Bank

- Treasury Prime

- ADVAPAY OÜ

- Technisys

Connect with Our Sales Team Now to Explore the In-Depth Insights in This Report and Drive Your Business Forward!

More Valuable Insights

Future Market Insights, in its new offering, presents an unbiased analysis of the Global Banking-as-a-Service (BaaS) Platform market presenting a historical analysis from 2018 to 2022 and forecast statistics for the period of 2023 to 2033.

The study reveals essential insights By Solution (Banking as a Service Platform, Banking as a Service APIs, Services), Enterprise Size (Small & Mid-sized Organizations, Large Organizations), End User (Banks, FinTech Corporations, Investment Firms) & Region.

Key Segments Covered in the Banking as a Service (BaaS) Platform Industry Survey

By Solution:

- Banking as a Service Platform

- Banking as a Service APIs

- Services

- Payment Processing Services

- Digital Banking Services

- KYC Services

- Customer Support Services

- Others

By Enterprise Size:

- Small & Mid-sized Organizations

- Large Organizations

By End-User:

- Banks

- FinTech Corporations

- Investment Firms

- Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia

- Oceania

- Middle East and Africa

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube